business inventories ap macro sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

Business inventories ap macro explores how companies manage their stock of goods and the vital role these inventories play in the broader economy. From acting as a key economic indicator to influencing aggregate expenditure and signaling shifts in economic cycles, understanding business inventories is crucial for students and anyone interested in how economies tick. This topic uncovers how inventory levels are measured, interpreted, and managed, highlighting their impact through real-world examples and modern inventory management strategies.

Definition and Importance of Business Inventories in Macroeconomics

Business inventories refer to the stocks of finished goods, work-in-progress, and raw materials that firms hold at any given time. In macroeconomics, business inventories serve as a bridge between production and sales, providing valuable insights into the health and direction of the economy.

These inventories are considered a vital economic indicator because changes in inventory levels can signal shifts in economic activity. When inventories rise or fall unexpectedly, it often reflects changes in consumer demand, production adjustments, or even anticipation of future market conditions.

Business Inventories as an Economic Indicator, Business inventories ap macro

In macroeconomic analysis, tracking business inventories helps economists and policymakers interpret the current phase of the economic cycle. Rising inventories may indicate slowing demand or overproduction, while declining inventories often suggest strong sales or cautious production planning.

Business inventories in macroeconomics are defined as the total value of unsold goods and materials held by businesses, acting as a buffer between production and consumption.

Inventory fluctuations often correspond with economic cycles. During expansions, businesses may accumulate inventories in anticipation of higher sales. Conversely, in contractions, firms often reduce inventories to avoid excess stock and mitigate losses.

The Role of Business Inventories in Aggregate Expenditure

Within the aggregate expenditure model, business inventories play a unique role as both a component of output and a signal for future production trends. Aggregate expenditure is the total amount spent on an economy’s goods and services at a given price level, and inventories help balance the difference between what is produced and what is purchased.

Components of Aggregate Expenditure and the Place of Inventories

The aggregate expenditure model typically comprises four major components. The inventory component serves as a buffer, absorbing discrepancies between output and planned spending. Here’s how inventories are represented:

| Component | Description | Inventory Role | Contribution to Output |

|---|---|---|---|

| Consumption (C) | Spending by households on goods and services | Indirect, as inventory changes reflect unpurchased goods | Drives production; unsold goods add to inventories |

| Investment (I) | Business spending on capital and inventories | Direct; changes in inventories classified as investment | Inventory accumulation is counted as part of investment |

| Government Spending (G) | Purchases by government entities | May include inventory purchases for public stockpiles | Can influence production and inventory planning |

| Net Exports (NX) | Exports minus imports | Exports reduce inventories, imports add to available supply | Affects domestic inventory levels indirectly |

Unexpected inventory changes affect total output. For example, if firms sell more than expected, inventories drop, prompting them to increase production. If sales fall short, unsold goods accumulate, leading firms to cut back on output.

Inventory Adjustments and Economic Fluctuations

Firms continually adjust their inventory levels based on current sales trends, future expectations, and broader economic conditions. These adjustments are essential for maintaining efficiency and minimizing costs, but they also provide macroeconomic signals about where the economy may be headed.

Inventory Accumulation during Economic Expansion versus Contraction

Inventory behaviors differ significantly between phases of the business cycle. The following points Artikel these contrasts:

- During expansions, firms typically build up inventories, anticipating robust demand and aiming to avoid stockouts.

- In contractions, businesses often liquidate excess inventory, either due to reduced demand or in preparation for leaner times.

- Sudden shifts in inventory levels can signal turning points in the economic cycle, such as the onset of a recession or recovery.

For instance, in 2008, many companies sharply reduced inventories as the financial crisis unfolded, which amplified the downturn as production cuts rippled through supply chains. Conversely, inventory restocking in subsequent years signaled the beginning of an economic recovery.

Examples of Inventory Adjustments as Economic Signals

A surge in car manufacturers’ inventories due to declining auto sales can indicate weakening consumer confidence. Alternatively, retailers rapidly restocking shelves before a major holiday season may reflect expectations of strong consumer spending, often preceding a boost in GDP growth.

Measuring and Reporting Business Inventories

Governments and statistical agencies rely on systematic approaches to measure and report business inventories, providing critical data for economic analysis. These measurements form part of the regular economic releases that inform policy and investment decisions.

Standard Methods for Inventory Measurement

Inventory data is typically collected through business surveys and administrative records. Agencies such as the U.S. Census Bureau conduct monthly and quarterly surveys across sectors like manufacturing, wholesale, and retail to gather comprehensive inventory information.

| Step | Description |

|---|---|

| 1 | Data collection: Surveys sent to businesses to report inventory levels at period end. |

| 2 | Data validation: Agencies check for consistency and correct anomalies in responses. |

| 3 | Aggregation: Inventory data from various sectors are combined for macro totals. |

| 4 | Reporting: Official statistics are published, often monthly, as part of economic reports. |

The release of inventory data can influence market expectations and policy. For policymakers, rising inventories may suggest overproduction or slowing demand, warranting monetary or fiscal adjustments. For investors, inventory trends can signal profit opportunities or risks within specific industries.

The Multiplier Effect and Inventories

Business inventories play a crucial role in the multiplier effect, where initial changes in spending lead to larger changes in overall economic output. This relationship is especially evident when inventory adjustments are unplanned, as they directly influence GDP growth.

Unplanned inventory accumulation occurs when actual sales fall below expectations; in response, businesses decrease future production, amplifying the initial decrease in demand through the multiplier effect.

For example, if retailers overestimate demand during the holiday season and end up with excess stock, they may cut back on future orders. This reduction lowers incomes for suppliers, which in turn reduces spending throughout the economy, illustrating the multiplier in action.

Conversely, unexpected inventory depletion can trigger a production boost, raising incomes and further stimulating demand. In both cases, inventory adjustments ripple through the economy, affecting national income beyond the initial change.

Business Inventories and Real-life Examples: Business Inventories Ap Macro

Significant swings in business inventories have shaped macroeconomic outcomes throughout history. Analyzing these events provides valuable lessons about the interconnectedness of inventory management and economic performance.

| Year | Industry | Inventory Change | Economic Impact |

|---|---|---|---|

| 2008 | Automotive | Rapid inventory liquidation | Signaled recession onset, led to production cuts and job losses |

| 2020 | Retail | Sharp decline due to panic buying | Stressed supply chains, followed by rapid restocking |

| 2021 | Semiconductors | Severe inventory shortages | Disrupted global manufacturing, highlighted supply chain vulnerabilities |

These examples reveal how inventory dynamics can amplify economic shocks or signal recovery. They also underscore the importance of responsive inventory management to minimize negative impacts and capitalize on growth opportunities.

Managing Inventories: Strategies and Impacts

Effective inventory management is essential for businesses to remain agile in the face of macroeconomic fluctuations. Firms adopt various strategies to optimize inventory levels and minimize costs while maintaining the ability to meet demand.

Inventory Management Methods and Macroeconomic Implications

Several widely used inventory management methods have macroeconomic consequences. The following points highlight key approaches:

- Just-In-Time (JIT): Minimizes inventory holding costs by aligning production closely with demand, reducing excess stock but potentially increasing vulnerability to supply chain disruptions.

- Economic Order Quantity (EOQ): Balances ordering and holding costs to determine optimal order sizes, helping firms avoid overstocking or stockouts.

- ABC Analysis: Classifies inventory items by importance, allowing businesses to focus resources on high-value goods and reduce waste.

- Technological adoption: The use of real-time inventory tracking and automation enhances efficiency and enables faster response to changing market conditions.

Technological advancements such as RFID, cloud computing, and AI-driven analytics have revolutionized inventory tracking and management. These tools provide greater visibility and control, enabling firms to react swiftly to macroeconomic shifts and consumer trends.

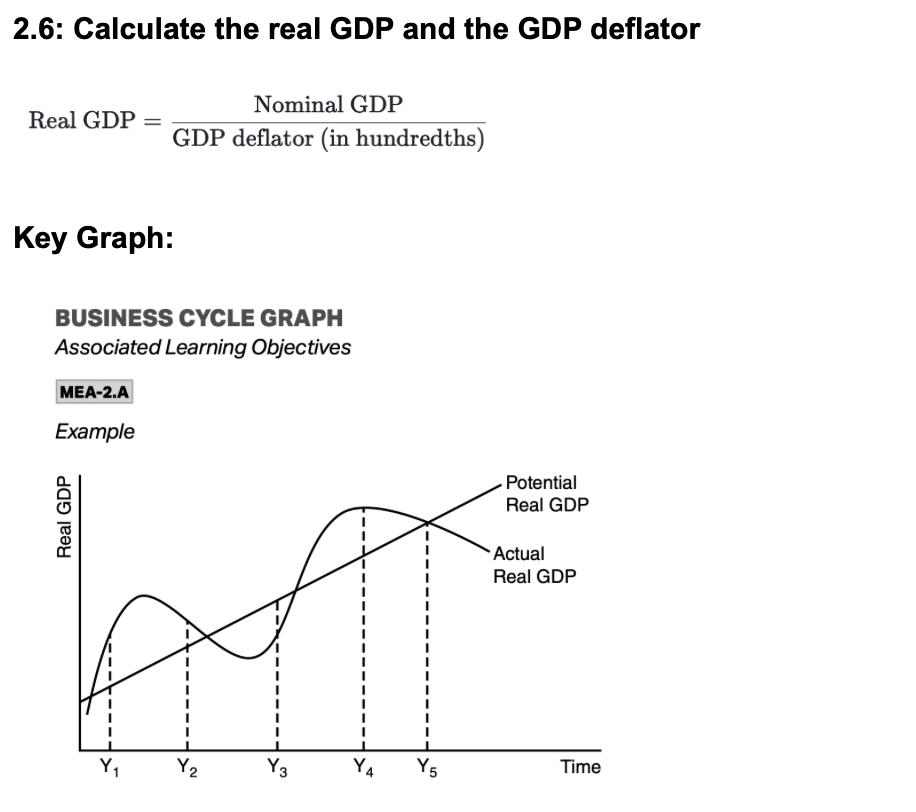

Visualization: Interpreting Inventory Data Trends

Interpreting business inventory trends often involves analyzing time series graphs, which help identify patterns, seasonal effects, and potential turning points in the economic cycle.

Essential Elements for Clarity in Inventory Data Visualization

Clear and informative inventory graphs should include several key visual elements:

- Descriptive labels for axes and data series

- Trend lines to highlight overall direction

- Markers for significant events, such as policy changes or economic shocks

- Comparison series, such as GDP growth or retail sales, for context

When reading inventory data visualizations, look for inflection points where inventory levels shift direction; these often coincide with changes in economic momentum and can foreshadow broader business cycle movements.

By carefully analyzing the relationship between inventory trends and other macroeconomic indicators, businesses and policymakers can make more informed decisions, anticipate market shifts, and respond proactively to emerging challenges.

Last Recap

In summary, business inventories ap macro offers a fascinating look at how something as routine as stock management can have far-reaching effects on the whole economy. By examining how inventories interact with macroeconomic principles, influence policy decisions, and reflect economic trends, it becomes clear how vital these metrics are for businesses, policymakers, and analysts alike. This understanding helps make sense of economic reports and provides valuable insight into the forces that drive economic growth and cycles.

Expert Answers

How do business inventories affect GDP?

Business inventories are part of GDP calculations. Changes in inventory levels are counted as investment, so if inventories rise, they contribute positively to GDP; if they fall, they reduce GDP.

Why are unexpected changes in inventories important?

Unexpected inventory changes often signal differences between what businesses expected to sell and actual sales, which can indicate shifts in consumer demand or economic turning points.

What is the difference between planned and unplanned inventory changes?

Planned inventory changes are increases or decreases that businesses anticipate and control, while unplanned changes occur when actual sales differ from expectations, leading to unexpected stock buildup or depletion.

How often are business inventories reported?

In most economies, business inventory data is collected and reported monthly or quarterly by government statistical agencies.

Can inventory management strategies influence the overall economy?

Yes, widespread adoption of efficient inventory management, like Just-In-Time systems, can reduce volatility in inventory levels and make economic fluctuations less severe.