crm accounting sets the stage for a new era of business management where customer relationships and financial data come together to drive smarter decisions. Imagine having a unified platform that gives you a complete view of your clients while keeping your accounts in perfect order—this is the promise that crm accounting delivers.

At its core, crm accounting bridges the gap between two essential business functions by integrating customer relationship management with robust accounting features. This combination streamlines workflows, automates key processes, and makes your data more accessible and actionable than ever before. Whether you’re managing invoices, tracking customer interactions, or generating real-time reports, crm accounting empowers organizations of any size to work smarter and grow faster.

Introduction to CRM Accounting

Customer Relationship Management (CRM) accounting represents a strategic fusion of financial management and customer-centric operations in modern businesses. This integration leverages CRM’s robust client management capabilities with the accuracy and compliance focus of accounting systems, allowing organizations to track, reconcile, and analyze both customer interactions and financial data from a unified platform.

Over the years, accounting practices have evolved from manual bookkeeping and basic standalone software to interconnected systems that streamline every stage of the customer and revenue journey. CRM systems initially supported sales, service, and marketing, but as businesses recognized the value of seamless data flow, these platforms began incorporating core accounting features. The result is a sophisticated solution that not only manages invoices and payments but also improves decision-making through holistic visibility.

Primary Functions Integrating CRM and Accounting, Crm accounting

Integrating CRM with accounting systems creates several high-impact functionalities. These include:

- Centralized database for client and financial records

- Automated invoicing, billing, and payment tracking

- Real-time financial reporting linked to customer activities

- Sales pipeline management with direct revenue forecasting

- Enhanced compliance and audit trail creation

By marrying CRM and accounting, businesses gain a comprehensive view of the customer lifecycle and its direct impact on financial performance.

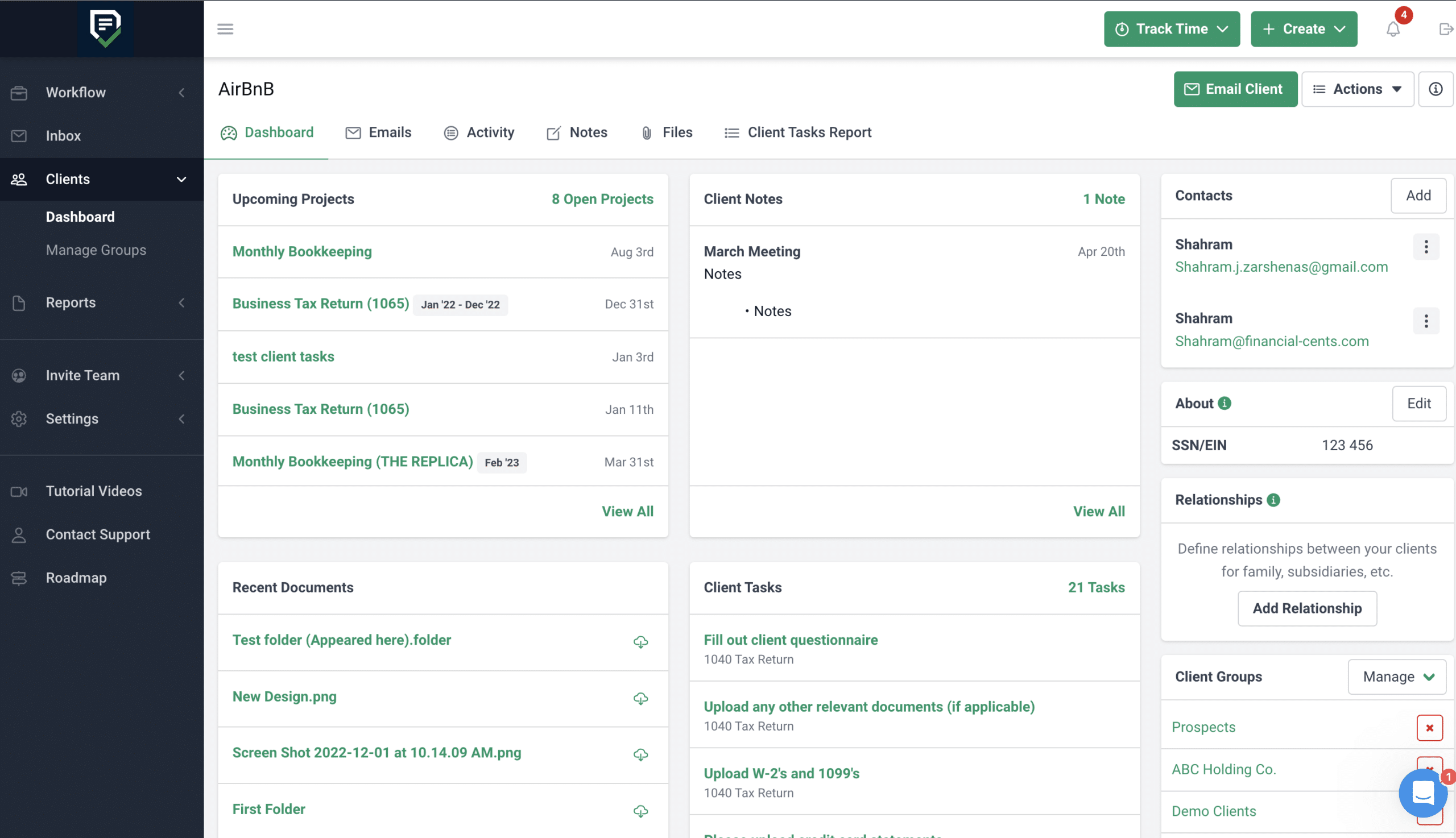

Core Features of CRM Accounting Software

CRM accounting software solutions have become increasingly sophisticated, offering a suite of features designed to optimize both financial and customer management. A well-designed platform automates tasks, reduces manual errors, and ensures transparency across all business units.

Essential Features in Leading CRM Accounting Solutions

Modern CRM accounting systems typically provide:

- Contact and account management tied directly to billing records

- Automated invoice generation and receivables tracking

- Sales and revenue analytics

- Integration with banking and payment gateways

- Customizable workflow automation

- Multi-currency and multi-entity support

- Real-time dashboards and reporting tools

Comparison of Popular CRM Accounting Platforms

The table below compares four widely used CRM accounting platforms and their core features for quick reference.

| Platform | Contact Management | Invoice Automation | Customizable Reporting | Workflow Automation |

|---|---|---|---|---|

| Salesforce Accounting Integration | Yes | Yes | Yes | High |

| Zoho Books + CRM | Yes | Yes | Yes | Medium |

| Sage Intacct with CRM | Yes | Yes | Advanced | High |

| QuickBooks CRM Integration | Yes | Yes | Basic | Medium |

How Automation Streamlines Management Processes

Process automation is a central benefit of CRM accounting software. Automated workflows ensure that client onboarding, invoicing, payment reminders, and reconciliations occur without manual intervention. This not only saves time but also reduces the risk of human error.

For example, when a sale is closed, the system can automatically generate an invoice, log it in the accounting records, and send reminders to the client. Automated reporting tools then consolidate all this data, providing insightful visualizations and actionable intelligence.

Consistent automation through CRM accounting improves efficiency, enhances client experiences, and accelerates the financial cycle from prospect to payment.

Benefits of Integrating CRM with Accounting

Integrating CRM with accounting software provides a unified solution that empowers teams to collaborate seamlessly and make data-driven decisions. Centralizing financial and customer data eliminates silos, supports more accurate forecasting, and enables a superior customer experience.

Key Advantages of CRM-Accounting Integration

The synergy between CRM and accounting delivers tangible business benefits such as:

- Streamlined workflow between sales, finance, and operations teams

- Faster, more accurate invoicing and payment collection

- Improved cash flow visibility and management

- Enhanced customer service due to real-time account information

- Centralized reporting and analytics for better strategic planning

- Reduced duplication of data entry and minimized errors

Examples of Improved Workflow and Customer Relations

Integrating CRM with accounting transforms day-to-day operations. Some concrete examples include:

- Sales reps can access customer payment history when negotiating contracts, ensuring terms fit the client’s profile.

- Finance teams receive automatic notifications of overdue invoices, enabling timely follow-ups.

- Customer queries about billing are resolved faster because all information is housed in one place.

Scenarios Supporting Business Growth and Compliance

Integration is particularly valuable in scenarios where rapid growth or regulatory compliance is a priority. For instance, a scaling SaaS company can use CRM accounting to generate audit-ready reports in seconds, or a retail chain can manage multi-location financials while maintaining compliance with tax laws.

Integrated platforms enable businesses to adapt and expand, meeting changing regulatory or market demands with agility and confidence.

Methods for Implementing CRM Accounting Systems

Successful implementation of CRM accounting systems requires careful planning, resource allocation, and change management. Organizations must choose a strategy aligned with their goals, resources, and timelines.

Step-by-Step Procedures for Implementation

Implementation typically follows these steps:

- Assess current processes and define integration objectives

- Select a CRM accounting solution compatible with business needs

- Map out required data migration and integration workflows

- Allocate resources and assign project roles

- Customize the platform to fit organizational requirements

- Conduct training and change management for end-users

- Test, deploy, and monitor system performance

Comparison of Implementation Strategies

Different organizations may favor different approaches. The table below summarizes common strategies, resources, timelines, and scenarios for best use:

| Method | Required Resources | Typical Timeline | Best Use Case |

|---|---|---|---|

| Phased Rollout | Internal IT, Vendor Support | 3-6 months | Enterprises with complex, multi-department structures |

| Big Bang Implementation | High internal/external support | 1-2 months | SMBs seeking rapid transition |

| Pilot Program | Project Team, Selected Users | 2-4 months | Organizations testing new features with limited risk |

| Parallel Adoption | Extra staff, dual-system management | 4-6 months | Firms requiring validation before full adoption |

Guidance on Migrating from Traditional Accounting

Migrating from standalone to integrated CRM accounting systems requires thoughtful data cleansing, migration planning, and legacy system decommissioning. Companies should back up historical records, map legacy data fields to new system structures, and run parallel operations during the initial transition period to ensure accuracy and business continuity.

A methodical approach to migration safeguards data integrity and minimizes disruption during digital transformation.

Closing Notes: Crm Accounting

Bringing together the strengths of crm and accounting, crm accounting equips businesses with powerful tools to stay ahead in a competitive landscape. By uniting client management and financial operations, it delivers efficiency, transparency, and adaptability. As technology continues to evolve, crm accounting will remain central to helping organizations manage growth, maintain compliance, and provide outstanding customer experiences.

FAQ

What types of businesses benefit most from crm accounting?

Small, medium, and large businesses across industries that need to integrate customer data with financial processes benefit the most, especially those aiming to improve workflow efficiency and client engagement.

Is crm accounting software difficult to implement?

Implementation depends on the platform and business size, but most modern solutions offer step-by-step guidance and migration tools to simplify the process.

Can crm accounting handle multiple currencies and tax rules?

Many crm accounting platforms support multiple currencies and customizable tax settings to accommodate global business needs.

How does crm accounting improve data accuracy?

By centralizing customer and financial information, crm accounting reduces manual data entry and errors, resulting in more accurate records and reporting.

Is my data safe in a crm accounting system?

Most crm accounting solutions prioritize security with encryption, access controls, and regular compliance updates to protect sensitive financial and customer data.